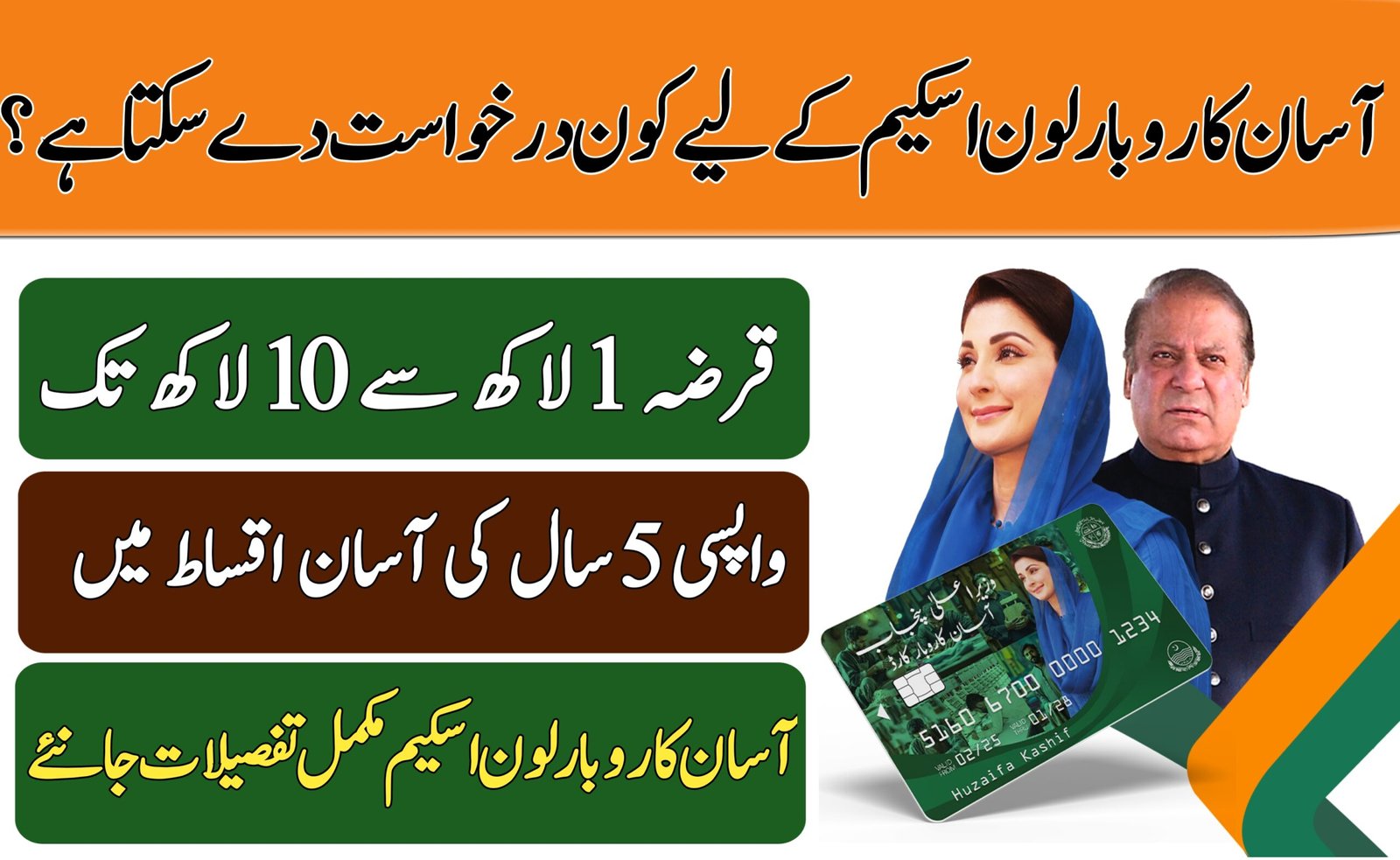

Asaan Karobar Finance Scheme Online Registration Details: A New Update to Help You Expand Your Business

Online Enrollment for the Asaan Karobar Finance Scheme

Register online for the Asaan Karobar Finance Scheme to expand your company.

Punjab Chief Minister Maryam Nawaz Sharif launched this program to provide a remarkable opportunity for new businesses and entrepreneurs. The Asaan Karobar Finance Scheme offers interest-free loans ranging from Rs 1 million to Rs 30 million, divided into two tiers:

- Tier 1: Loans between Rs 1 million and Rs 5 million require only personal guarantees.

- Tier 2: Loans between Rs 6 million and Rs 30 million require property or asset guarantees.

Applications can now register online with ease by visiting akf.punjab.gov.pk and entering their information. Following registration,

The Bank of Punjab will verify the application and then disburse the loan. Additionally, this system offers specific incentives for women, individuals with disabilities, and transgender people, such as a requirement of only 10% equity investment.

In addition to helping individuals launching new companies, this plan will offer a chance to update and grow already-existing companies. This initiative is a fantastic opportunity for you if you meet the requirements and are a permanent resident of Punjab. Put in an online application right now to make your business idea a reality. We will walk you through the scheme’s goals, eligibility requirements, loan specifics, and the online registration process step-by-step in this post.

The Asaan Karobar Finance Scheme’s goals

The goal of Punjab’s Asaan Karobar Finance Scheme is to empower people and companies. Among its main goals are:

- Supporting Startups: Providing start-up capital to assist new companies in getting off the ground.

- Extending Current Businesses: Encouraging the expansion, modernization, and diversification of already-existing businesses.

Encouraging environmentally friendly and sustainable business activities is known as “promoting climate-friendly businesses.”

Developing Employment Possibilities: creating jobs in a variety of businesses to lower Punjab’s unemployment rate.

The government’s dedication to encouraging entrepreneurship and advancing the province’s economy is demonstrated by this program.

For whom is the Asaan Karobar Finance Scheme applicable?

The following conditions must be fulfilled in order to apply for the Asaan Karobar Finance Scheme:

- You have to live in Punjab permanently.

- Candidates must be between the ages of 25 and 55.

- You need to have an active Federal Board of Revenue (FBR) tax filing account.

- Eligible are small businesses with yearly sales up to PKR 150 million.

- Applications are also accepted from medium-sized businesses with annual sales ranging between PKR 150 million and PKR 800 million.

- Your home and place of business must be in Punjab.

- Your CNIC, NTN (National Tax Number), and documentation of business ownership or lease are required.

Asaan Karobar Finance Scheme Loan Information and Types

Loans are categorized based on the amount, depending on the quantity.

PKR 1–5 million is the loan amount for Tier 1.

- Security: No collateral is needed, just a personal guarantee.

- Processing Charge: 5,000 PKR.

- Tenure: Payable over a maximum of five years.

- Interest Rate: There is no interest at all.

PKR 6–30 million is the loan amount for Tier 2.

Security: Assets or property must be used as collateral.

- The processing fee is 10,000 PKR.

- Tenure: Payable over a maximum of five years.

- Interest Rate: There is no interest at all.

- Both categories provide financial assistance without placing a financial strain on borrowers, which appeals to business owners.

Detailed Instructions for Online Registration

It is simple to register online for the Asaan Karobar Finance Scheme. To apply, take these actions:

Go to the official website: Kindly visit akf.punjab.gov.pk.

Register or Login: Click the “Register Now” button if you’re a new user, or use your username and password to log in if you’re an existing user.

- Give precise details, such as your name (as stated on your CNIC).

- The name of the husband or father.

- Contact information, email address, and CNIC number.

- Residential address with tehsil, division, district, and province included.

- Information about the business, such as ownership status and NTN.

- Create a Password:

- After creating a strong password, select “Register.”

- Check Your Email:

- Your registered email address will receive a verification email. In order to activate your account, click the link in the email

Details of Loan Disbursement and Repayment

Within the first six months of obtaining the card, the first 50% of the loan is available.

To access the second half, make sure you use it responsibly and make your repayments on schedule.

Borrowers must demonstrate responsible use of the first half and register with the PRA/FBR to receive the second half of the loan.

Grace Timeframe: Startups: Up to six months before to the start of repayment.

Current Companies: For a maximum of three months.

- Borrowers must repay a minimum of 5% of the total loan amount each month, with the repayment spread across 24 equal monthly installments.

Advantages of the Plan

The Asaan Karobar Finance Scheme provides candidates with a number of advantages, such as:

- Interest-free loans allow you to borrow money without having to worry about exorbitant interest charges.

- Special accommodations for women, transgender people, and people with disabilities are part of the inclusive program.

- Climate-Friendly Companies: Extra rewards for environmentally friendly company operations.

- Simplified Web-Based Application: Easy and intuitive registration procedure.

- Economic Growth: Helps Punjab’s economy as a whole and creates jobs.

Common Errors to Steer Clear of

Steer clear of the following errors to guarantee a seamless application process:

- Inaccurate Information: Verify that your email address, contact information, and CNIC are correct.

Missed Deadlines: To prevent delays, submit your application on time.

Extra Fees and Requirements for the Asaan Karobar Finance Plan

Even if the loans have no interest, there are a few fees to take into account:

- PKR 25,000 + FED is the annual card fee.

- Fees for late payments: assessed in accordance with bank regulations.

Verification and Registration: Within six months, you must physically verify your company’s location and register with PRA/FBR.

In conclusion

Businesses in Punjab can receive financial support through the innovative Asaan Karobar Finance Scheme. This program is a great way for business owners to expand their operations because it offers interest-free loans, a straightforward online application process, and assistance for both new and established companies.

Don’t pass up this opportunity to apply if you fit the eligibility requirements. Get your company capital now by completing the registration process and getting your paperwork ready. Let’s work together to support Punjab’s economic growth.