Procedure for Registering a Chief Minister Asaan Karobar Card, Eligibility Requirements, and Registration Documents

Card of Chief Minister Asaan Karobar

With the inauguration of the Asaan Karobar Card, Punjab Chief Minister Maryam Nawaz Sharif has made it possible for all small business owners in the province to obtain loans from the Punjab government ranging fromh to ope Rs 1 Lakh to Rs 10 Lakrate their enterprises.

You have three years to repay the Punjab government for this interest-free loan. This loan is available for use for a full year. The Punjab government has announced that repayment must be made in equal monthly installments over the next two years, beginning with the first year.

The Punjab government has announced that you would have a grace period for the first three months of the loan, for your convenience. Through the Asaan Karobar Card portal (akc Punjab gov pk), you can submit your application. The Punjab government has set a registration cost of Rs 500, which is required for every application.

The Asaan Karobar Card Scheme’s salient features

- One exceptional scheme for Punjabi small business owners is the Asaan Karobar Card. Here are some of its noteworthy attributes:

- Interest-Free Loans: The program provides interest-free loans, which make it feasible for small enterprises to prosper.

Loan Tenure: The loan can be repaid over a period of three years.

Grace Period: Before repayment starts, there is a three-month grace period.

Flexible Use: To ensure flexibility in use, beneficiaries may spread out the loan amount over a 12-month period.

Equal Monthly Installments: After the first year, the remaining loan will be repaid in equal monthly installments over the course of two years.

Eligibility Criteria for the Asaan Karobar Card

The program has set specific eligibility criteria to ensure it supports the right individuals.

- Candidates must be between the ages of 21 and 57.

- must reside in Punjab and be a citizen of Pakistan.

- It is necessary to have a registered cellphone number and a valid CNIC.

- must be a Punjabi small business owner.

- Each business may only submit one application.

- The applicant must have never taken out a business loan from a public or private organization before.

- Only business-related uses are permitted for the loan.

- It is necessary to pass the psychometric evaluation test.

The requirements to be eligible for the Asaan Karobar Card

To ensure the program benefits the right individuals, the following specific eligibility criteria have been established:

- Candidates must be between the ages of 21 and 57.

- must reside in Punjab and be a citizen of Pakistan.

- It is necessary to have a registered cellphone number and a valid CNIC.

- must be a Punjabi small business owner.

- Each business may only submit one application.

- The applicant must have never taken out a business loan from a public or private organization before.

- It is necessary to pass the psychometric evaluation test.

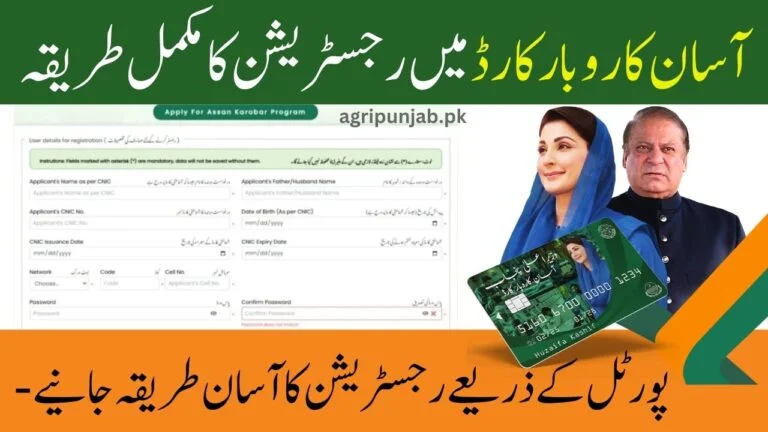

A Comprehensive Guide to Registration

A simplified online application process makes it simple for qualified persons to apply for the Asaan Karobar Card. Take these actions:

- Go to the Portal: Go to akc Punjab gov pk, the official website.

- Begin the registration process: Accept the terms and conditions by clicking the “Apply for Asaan Karobar Card” button.

- Enter your personal information. Give information such as your name and father’s name.

- Issue date, CNIC number, and expiration date

- Mobile number and mobile network code

- Create an Account: After creating and verifying a password, select “Register.”

- Sign in: To access your account, enter your login credentials.

- Give your business’s details: Enter crucial details about your company, like:

- The type of business

- Name and address of the business

- Details of monthly income and expenses

- Information about a partnership or shareholder, if any

- Loan Specifics: Indicate

Recall:

To finish the process, a non-refundable registration fee of Rs 500 must be paid.

Details of Loan Use and Repayment

Details of Loan Use and Repayment

It is crucial for candidates to comprehend the loan utilization and payback process:

Use of the First Installment: Recipients utilize half of the loan balance during the initial six months.

- Frequent payments

- registering with PRA or FBR.

- Payback Schedule:

- There is a grace period of three months.

- Repayment Period: Borrowers must repay the loan in equal monthly installments over two years.

- Bills for taxes

- Operational requirements

- The authorized loan payments will be subject to an annual charge of Rs 25,000 (plus FED).

- Extra Fees: includes delivery fees, card issuance, and life insurance. According to the bank’s policy, late payments are subject to penalties.

Extra Instructions for Recipients

- To guarantee seamless payback and processing:

- you prevent late fees, make sure you deposit loan payments on time.

- According to the guidelines, only use the loan for business reasons.

- To obtain the entire loan amount, continue to abide by government restrictions.

In summary:

When it comes to Punjabi small business owners, the Asaan Karobar Card is revolutionary. Under the direction of Maryam Nawaz Sharif, the Punjab government is encouraging economic growth and entrepreneurship by providing interest-free loans with adjustable payback schedules. Don’t pass up this fantastic chance to grow your company if you fit the eligibility requirements.